Li-S Energy’s Rising Losses Highlight Risks in Battery Commercialisation

Li-S Energy Limited reported a $6.41 million net loss for FY25 while making significant strides in commercialising its lithium-sulfur battery technology, including commissioning new production facilities and securing key strategic partnerships.

- Net loss after tax increased 39% to $6.41 million

- Commissioned Phase 3 and 3S lithium-sulfur battery production lines

- Established Australia’s first in-house lithium metal foil production

- Secured strategic collaborations with defence and aerospace sectors

- Maintained strong cash position of $14.86 million at year-end

Financial Performance and Losses

Li-S Energy Limited (ASX, LIS) reported a net loss after tax of $6.41 million for the year ended 30 June 2025, marking a 39% increase compared to the prior year’s $4.62 million loss. Despite the widening loss, the company’s financial position remains solid with $14.86 million in cash and net assets of $35.29 million, providing a runway to continue its commercialisation efforts.

Commercialisation Milestones

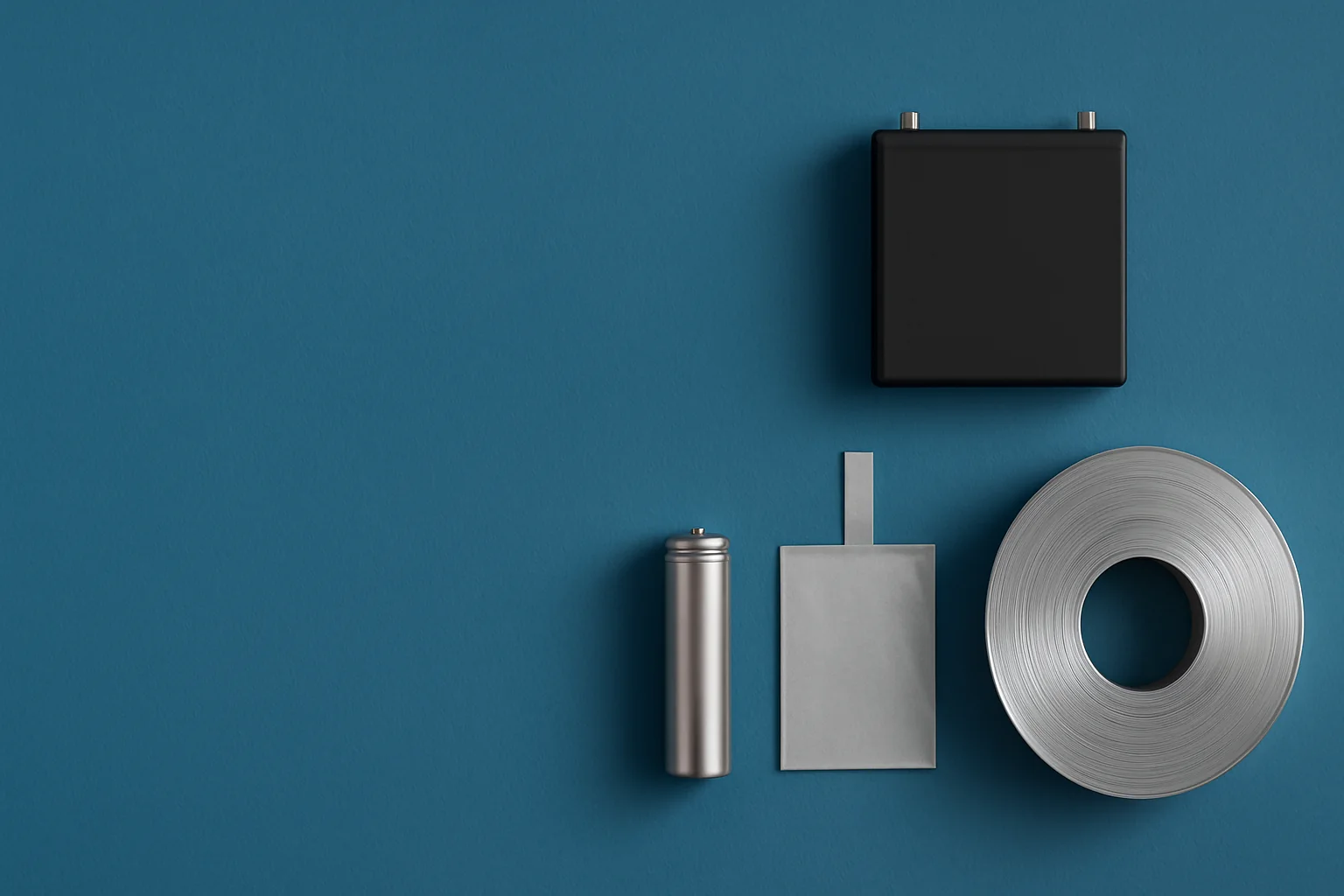

FY25 was a pivotal year for Li-S Energy as it transitioned from research to engineering-led battery manufacturing. The company successfully commissioned its Phase 3 production facility in Geelong, Australia, capable of producing 10Ah and 20Ah lithium-sulfur pouch cells at scale. Additionally, the smaller format Phase 3S line was brought online to serve defence and security applications.

Complementing cell production, Li-S Energy advanced its lithium metal foil production capability, installing Australia’s first lithium foil extruder and producing 100-micron thick foils ahead of schedule. This vertical integration addresses supply chain challenges and positions the company to offer lithium foils and laminates as a new revenue stream.

Strategic Partnerships and Market Validation

Li-S Energy expanded its commercial footprint through collaborations with defence prime contractors and aerospace companies. Notably, it supplied lithium-sulfur cells for testing in military-grade unmanned systems and partnered with New Zealand’s Kea Aerospace on high-altitude solar-electric UAV battery packs. The company also progressed the Emerging Aviation Technology Partnership’s Pegasus UAV program, aiming for extended endurance drone flights powered by Li-S batteries.

These partnerships validate the technology’s performance, safety, and energy density advantages, underpinning the company’s strategy to secure conditional offtake agreements and scale manufacturing in upcoming phases.

Research & Development and Intellectual Property

R&D remains a core focus, with Li-S Energy investing in proprietary semi-solid-state cathode chemistries, low-flammability electrolytes, and an intelligent battery management system tailored for lithium-sulfur cells. The company filed new patents and maintains a rigorous intellectual property protection program to safeguard its innovations.

Outlook and Strategic Priorities

Looking ahead, Li-S Energy aims to convert its growing pipeline of partner trials into revenue-generating contracts, expand government grant funding, and develop a scalable manufacturing model. The company is exploring licensing and joint venture opportunities to accelerate commercial supply beyond its Phase 3 facility, targeting a 1GWh production scale in Phase 4.

While losses are expected during this growth phase, the company’s strong cash position and strategic collaborations provide a foundation for sustainable progress in the emerging lithium-sulfur battery market.

Bottom Line?

Li-S Energy’s FY25 results underscore the challenges of early-stage battery commercialisation but highlight tangible progress that could reshape energy storage markets.

Questions in the middle?

- When will Li-S Energy secure binding offtake agreements to underpin Phase 4 scale-up?

- How will the company manage the transition from pilot production to commercial profitability?

- What impact will evolving battery safety regulations have on Li-S Energy’s technology adoption?