Coast Entertainment’s Growth Faces Uncertainty Amid Land Development Review

Coast Entertainment Holdings has reported a robust FY25 performance driven by the Rivertown launch, with FY26 off to a strong start bolstered by new attractions and growing visitation.

- FY25 ticket sales up 10.5%, visitation up 11.2%, surpassing pre-COVID levels

- Operating revenue reached $96.4 million, highest since FY16

- EBITDA surged 275% at group level, driven by theme park growth

- FY26 ticket sales up 54% year-on-year with record attendance

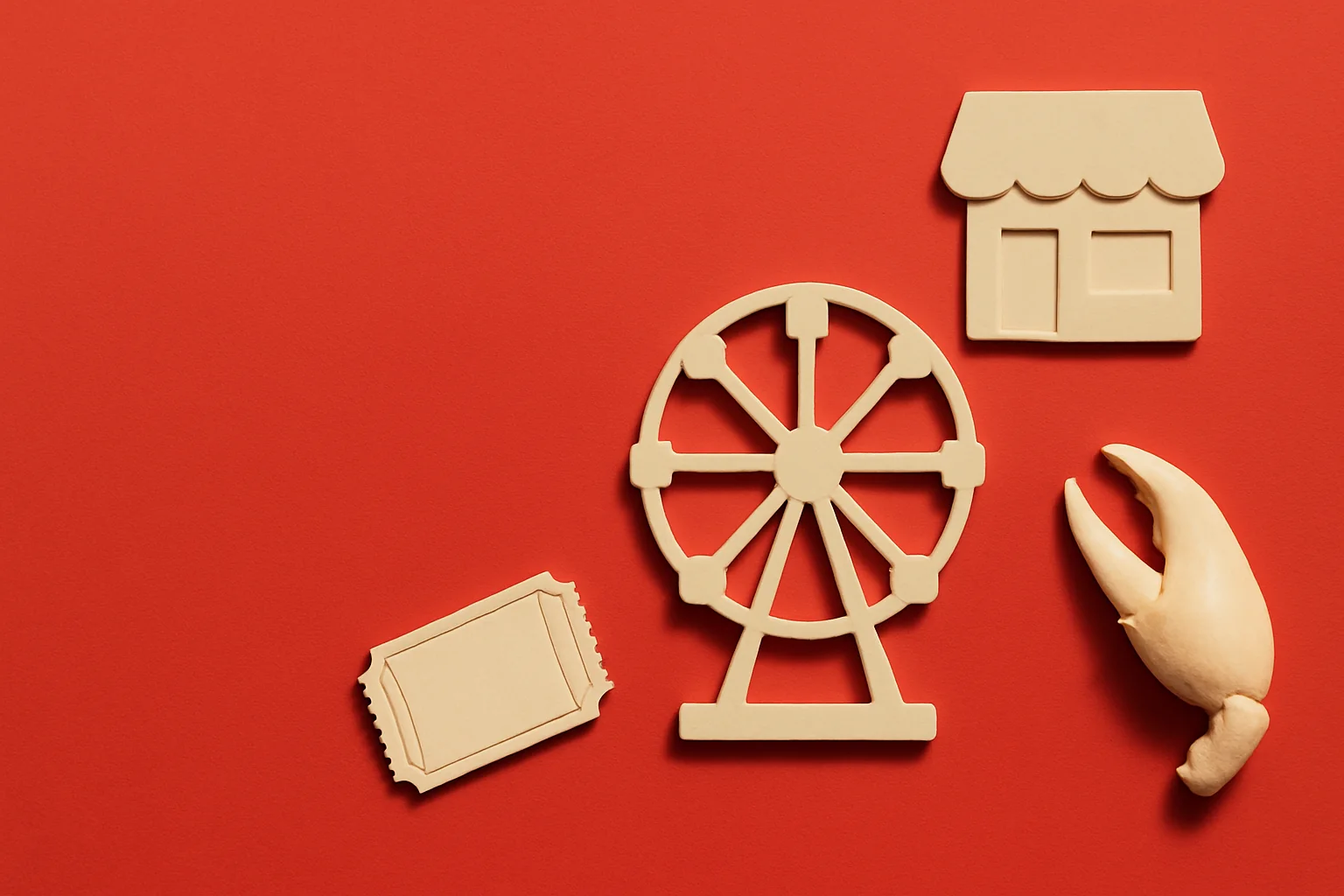

- King Claw attraction set to open December, promising further growth

Strong Momentum from Rivertown Launch

Coast Entertainment Holdings Limited has delivered a standout FY25, propelled by the successful launch of Rivertown at Dreamworld. This new family attraction, featuring the Jungle Rush coaster and enhanced dining options, has resonated strongly with visitors, driving a 10.5% increase in ticket sales and an 11.2% rise in visitation compared to the prior year. These gains notably outpace pre-pandemic levels, underscoring the appeal of the refreshed park experience.

The company’s operating revenue climbed 10.8% to $96.4 million, marking its strongest performance since FY16. This growth was supported by robust in-park spending across food, beverage, retail, and experiences, all exceeding historical benchmarks. The Group’s EBITDA also saw a dramatic uplift, with a 275% increase at the consolidated level, reflecting operational leverage and cost discipline.

FY26 Off to a Flying Start with New Attractions

Building on FY25’s momentum, Coast Entertainment has reported a strong start to FY26. Ticket sales for the first four months surged 54% year-on-year, with visitation up 35%, surpassing FY16 attendance figures. The October school holidays delivered record-breaking attendance, highlighting sustained consumer enthusiasm.

Key to this growth is the upcoming launch of King Claw, a major new thrill ride set to open by the end of the calendar year. Positioned as the largest gyro swing ride in the Southern Hemisphere, King Claw is expected to further elevate Dreamworld’s profile and attract new visitors.

Strategic Initiatives and Operational Excellence

Coast Entertainment’s success is underpinned by a multi-year focus on guest experience, safety, and operational reliability, with attraction uptime at an impressive 98%. The company has also expanded its brand reach through partnerships such as the new wildlife precinct with Australian Geographic and the return of Big Brother to Dreamworld, enhancing visibility and engagement.

Financially, the Group maintains a debt-free balance sheet and a healthy cash position, having completed a second on-market share buyback. Deferred revenue from annual passes continues to grow, reflecting a loyal and expanding customer base. Meanwhile, corporate costs have been significantly reduced, contributing to improved profitability.

Land Development Application Under Government Review

On the development front, Coast Entertainment’s land application in Queensland has been called in by the state Minister for direct assessment, replacing local council oversight. The timing of a final decision remains uncertain. The company has not committed to any specific land use plans but sees significant potential value in its property holdings, especially given the region’s growth prospects ahead of the 2032 Olympics.

Looking ahead, Coast Entertainment is focused on leveraging its strong operational base, strategic marketing initiatives, and new attractions to sustain growth and enhance shareholder value.

Bottom Line?

With strong operational momentum and new attractions on the horizon, Coast Entertainment is poised for continued growth, but regulatory and economic headwinds remain watchpoints.

Questions in the middle?

- How will the government’s decision on the land development application impact Coast’s long-term growth plans?

- Can the momentum in FY26 be sustained amid potential weather and economic uncertainties?

- What is the expected financial impact of the King Claw attraction once fully operational?