Adisyn Eyes Growth in Semiconductors, Weighs Sale of IT Services Unit

Adisyn Ltd has completed a strategic review, deciding to boost investment in its graphene-based semiconductor arm while exploring options to unlock value from its managed IT services business.

- Strategic review highlights growth potential in semiconductor subsidiary 2D Generation

- Increased capital allocation planned for graphene-based semiconductor technology

- Exploring sale or partnership options for Adisyn Services managed IT business

- No binding agreements yet on Adisyn Services transaction

- Company aims to maximise shareholder value through portfolio realignment

Strategic Review Unveils New Focus

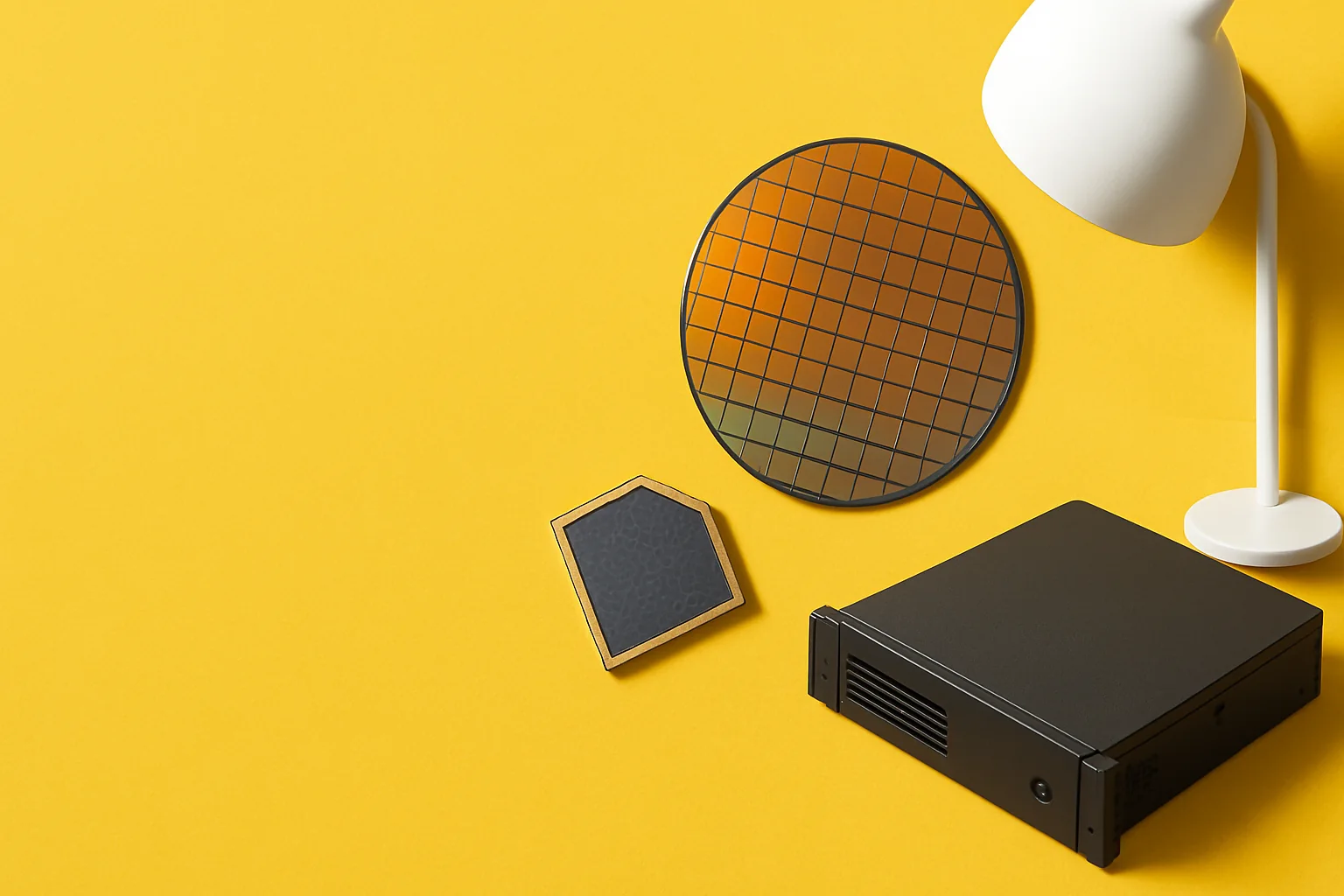

Adisyn Ltd (ASX, AI1) has announced the completion of a comprehensive strategic review of its asset portfolio, signaling a pivotal shift in its business focus. The review assessed the performance of its two main divisions, 2D Generation (2DG), a wholly owned subsidiary developing graphene-based semiconductor technologies, and Adisyn Services, which provides managed IT and cybersecurity solutions to small and medium enterprises.

Following this evaluation, the company has identified significant growth opportunities within its semiconductor business. This has led to a decision to allocate more capital and resources to 2DG, aiming to accelerate the development and commercialisation of its novel graphene-based atomic layer deposition technology. This technology promises to enhance semiconductor performance by enabling faster, stronger, and more energy-efficient computer processing.

Unlocking Value from IT Services

Concurrently, Adisyn is exploring strategic options for its managed IT services unit, Adisyn Services. The company is considering a range of possibilities including a sale or a change of control transaction with partners. While there has been inbound interest during the review process, no agreements have been finalized. The company remains committed to maximising shareholder value from this business segment and will provide updates as developments occur.

Managing Director Blake Burton emphasised the company’s ambition to revolutionise the semiconductor industry through its graphene technology, while pragmatically leveraging the IT services business to support this vision. The review ensures that 2DG is sufficiently resourced to pursue its growth potential, while the IT services arm could be repositioned to unlock additional value.

Looking Ahead

Adisyn’s strategic pivot reflects broader trends in the technology sector where semiconductor innovation is critical to future computing advancements. The company’s graphene-based approach could position it as a key player in overcoming current material limitations in semiconductor manufacturing.

Investors will be watching closely for further announcements regarding the potential transaction involving Adisyn Services and updates on the progress of 2DG’s technology development and commercial partnerships. The company’s ability to execute on these fronts will be crucial in determining its trajectory in the competitive tech landscape.

Bottom Line?

Adisyn’s refocused strategy sets the stage for a transformative chapter, but execution risks remain as it balances innovation with portfolio realignment.

Questions in the middle?

- What timeline and terms might emerge for a potential transaction involving Adisyn Services?

- How soon can 2D Generation’s graphene semiconductor technology reach commercial viability?

- What impact will increased capital allocation have on Adisyn’s overall financial health and shareholder returns?